In a move to increase operational efficiencies and accelerate its path to profitability, Navan, an expense management startup that was previously known as TripActions, has laid off approximately 5% of its workforce. According to a spokesperson for the company, this reduction in staff translates to around 145 people.

Background and Recent Developments

Navan’s decision to restructure comes on the heels of significant growth over the past three years, despite the challenges faced by the industry. The company has seen substantial increases in spend volume processed through its platform, with CEO Ariel Cohen announcing earlier this year that Navan Expense had experienced more than 3x growth in Q1 2023 compared to the same period in 2022.

Navan’s Expansion and Integration Efforts

In addition to its core travel expense management capabilities, Navan has expanded its offerings to include spend management services. This move was likely driven by the company’s experience during the COVID-19 pandemic, when revenues plummeted but were quickly recouped through innovative strategies.

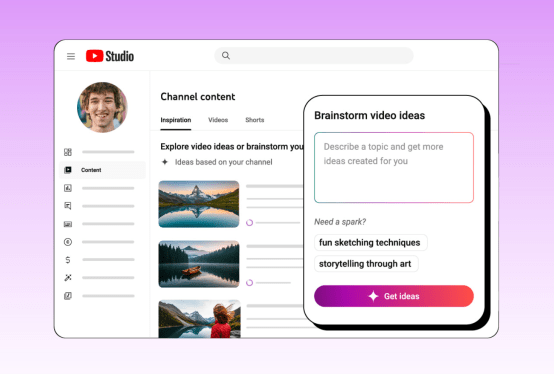

As part of its expansion efforts, Navan has integrated ChatGPT into its expense reports, allowing for more streamlined and efficient processing of expenses. Notably, both Ramp and Brex have also expanded their services to include travel management over the past couple of years.

Financial Performance and Future Plans

While Navan has historically kept its financials private, Cohen revealed earlier this year that revenue growth had reached 3x YoY (year-over-year). This figure is notable given the challenges faced by the industry.

Regarding plans to go public, Cohen expressed confidence in the company’s future prospects. He stated, "I think eventually we will be a public company. We’ve raised around $1.4 billion to date and maturity-wise, we are there, to be public. Growth-wise, we are growing extremely fast, and a lot of our metrics would support being public. I don’t think the market is there right now."

Investor Support and Market Sentiment

Navan’s decision to restructure may be seen as a strategic move to increase operational efficiencies and position itself for future growth. Given its strong financial performance and investor backing, including notable firms such as Andreessen Horowitz and Greenoaks Capital Management, the company appears well-positioned for continued success.

Impact on the Industry

The layoffs at Navan come amidst an industry-wide trend of consolidation and restructuring efforts. As companies seek to navigate the challenges posed by market fluctuations, changes in consumer behavior, and increasing competition, such moves may become more common.

In conclusion, Navan’s decision to cut 145 jobs is a strategic move aimed at positioning itself for future growth and profitability. Despite facing industry-wide challenges, the company’s strong financial performance and investor backing suggest that it remains well-positioned for success in the market.

Fintech News You May Have Missed

- Thomson Reuters Acquires Tax Automation Company SafeSend: Thomson Reuters has acquired tax automation company SafeSend for $600 million.

- Robinhood Has Aggressive Plans for 2025: Robinhood, already a ‘comeback’ stock, has even more aggressive plans for 2025.

Want More Fintech News?

Subscribe to our newsletter, The Interchange, to stay up-to-date on the latest fintech news and trends.