U.S. stocks turned lower in early Tuesday trading, while Treasury yields jumped, as investors looked to the first of a series of job market data releases that could test the market’s early January rally.

Jolted!

The number of unfilled jobs in the U.S. economy spiked to 8.01 million in November, according to the Labor Department’s job openings and labor turnover report, suggesting solid momentum into the final weeks of the year.

Key Statistics:

- The JOLTS report tally was up more than 400,000 from the October reading.

- The number of unfilled jobs is well ahead of the Street’s 7.84 million forecast.

Strong Service Sector Activity

The Institute for Supply Management posted its final reading of service sector activity over the month of December, which was not only stronger-than-expected but also included the biggest gain in ‘price paid’ by suppliers since February of 2023.

Market Reaction:

- The data lifted benchmark 10-year Treasury note yields rose 4 basis points to 4.679% in the wake of the data release.

- The S&P 500 gave back earlier gains to fall 15 points, or 0.25%, on the session.

Opening Bell

The S&P 500 was marked 18 points, or 0.31% higher in the opening minutes of trading, with the Nasdaq rising 21 points, or 0.11%. The Dow gained 164 points while the mid-cap Russell 2000 added 14 points, or 0.31%.

Micron Technology Shares Surge

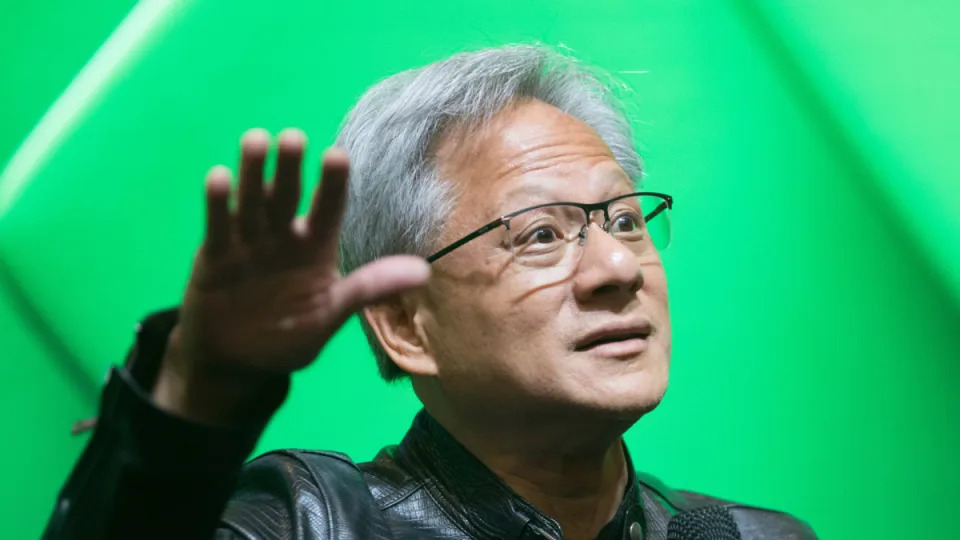

Micron Technology (MU) shares are a notable premarket mover after Nvidia CEO Jensen Huang named-dropped the memory chip maker as a key supplier to its new line of AI-powered gaming GPUs.

Key Highlights:

- Huang’s keynote address to CES 2025 in Las Vegas noted that Micron will provide memory for its new AI-powered personal computer, which is expected to launch later in the spring.

- Micron shares were last marked 3.8% higher in premarket trading to indicate an opening bell price of $103.05 each.

Stock Market Today

Stocks ended firmly higher on Monday, with megacap tech names and a fresh record high for Nvidia (NVDA) once again pacing gains and lifting the S&P 500 to a 0.55% advance by the close of trading.

Market Analysis:

- The Nasdaq jumped 1.24% as the tech sector continues to dominate investor sentiment while stoking worries of an overreliance on the so-called Magnificent 7.

- Nvidia shares, as well as the broader semiconductor space, are likely to be back in focus today following a keynote address by Chief Executive Jensen Huang to the Consumer Electronics Show in Las Vegas last night.

Labor Market Data Releases

The Labor Department will release its November job openings report later this morning, the first of four data releases over the week that conclude with Friday’s December nonfarm-payrolls update.

Economic Expectations:

- Economists are expecting to see a modest uptick in unfilled positions over the month, with a headline tally of 7.73 million.

- The so-called quits rate is likely to focus on determining labor-market momentum into the final weeks of last year.

Bond Markets

Bond markets will also be in focus with the sale of $39 billion in reopened 10-year notes that had been scheduled for later this week, but were brought forward to take advantage of favorable market conditions.

Market Reaction:

- The data lifted benchmark 10-year Treasury note yields rose 4 basis points to 4.679% in the wake of the data release.

- The S&P 500 gave back earlier gains to fall 15 points, or 0.25%, on the session.

Overseas Markets

In overseas markets, the regional Stoxx 600 benchmark nudged 0.15% higher in Frankfurt while Britain’s FTSE 100 slipped 0.21% in midday London trading.

Overnight Gains:

- Overnight in Asia, Japan’s Nikkei 225 followed last night’s rally on Wall Street with a solid 1.97% gain, helped in part by a weaker yen and rising chip stocks.

- The regional MSCI ex-Japan benchmark rose 0.19% into the close of trading.

Market Outlook

The market is expected to be volatile as investors digest the latest economic data releases and assess their impact on the overall economy.

Key Takeaways:

- The number of unfilled jobs in the U.S. economy spiked to 8.01 million in November, suggesting solid momentum into the final weeks of the year.

- The Institute for Supply Management posted its final reading of service sector activity over the month of December, which was not only stronger-than-expected but also included the biggest gain in ‘price paid’ by suppliers since February of 2023.

What to Watch

Investors will be closely watching the Labor Department’s November job openings report later this morning and assessing its impact on the overall economy.

Key Dates:

- The Labor Department will release its November job openings report later this morning.

- Friday’s December nonfarm-payrolls update is expected to provide further insight into the labor market.